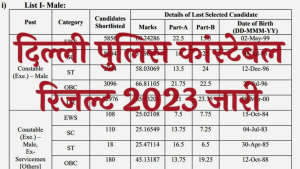

Delhi Police Constable Result 2023 दिल्ली पुलिस कांस्टेबल रिजल्ट 2023 जारी, यहां से चेक करें

Delhi Police Constable Result 2023: हेलो, दोस्तों आज हम आप सभी को हमारे पोस्ट में बताने वाले हैं दिल्ली पुलिस कांस्टेबल 2023 के रिजल्ट के बारे में। जैसा कि आप …